If you’ve been following the world of consumer tech for the last ten years, you know it’s become increasingly difficult for consumer internet startups to find scalable and cost-effective growth channels. As an investor in consumer internet companies, I’ve found this question – does a company have a scalable growth engine? – to be one of the most significant determinants of success or failure.

This post illustrates several traps to avoid and highlights three core strategies to help consumer Internet companies grow sustainably and generate value that lasts.

The Big Four Conundrum

First, let’s talk about the root issue. Over the past decade, Google and Facebook have grown their audience reach massively and collectively own a dozen different billion-user apps (Google: Search, Maps, Mail, Android, Chrome, YouTube, Google Play Store, Drive; Facebook: Facebook, Messenger, Instagram, WhatsApp). They’ve leveraged their dominant positions as aggregators of consumer attention to increase monetization, making it far more expensive (although still highly effective) for brands to reach consumer audiences on their platforms.

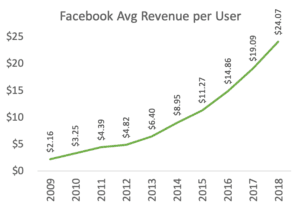

For example, take a look at Facebook’s ARPU (average revenue per user) — an indicator of how much advertisers spend in aggregate to reach the average Facebook user. Facebook’s ARPU has grown dramatically in recent years, and there’s no sign of slowdown. As a result, it’s now more than twice as expensive for a consumer CEO to reach the average Facebook user than it was just years ago.

Not to be left out, Apple has built a $46.6 billion/year App Store business by taking a 30% first-year toll on any mobile apps or media that consumers purchase through the App Store. And Amazon, in addition to its roughly 15% take-rate in its marketplace, has also quietly built a $10 billion/year advertising business, taking advantage of its position as the de facto starting point for product search to build a lucrative business sending leads to consumer product companies.

In total, consumer marketers spent over $200 billion in 2018 to acquire consumers on these four big platforms alonec(i). To put that in context, that’s nearly $30 in marketing spend for each human on earth. For many consumer startups, using these paid channels exclusively or without an informed strategy can make it extremely difficult to drive healthy growth.

Avoiding the Growth Paradox: Identifying Sustainable vs. Unsustainable Growth

At Sapphire Ventures, we meet a wide range of growth-stage consumer businesses and evaluate them across a full range of criteria. Team, market, and product are always essential factors for us. In addition, at growth-stage, one of the most important criteria is understanding growth efficiency. We try to answer questions like:

- What are the costs and ROI of adding new consumer users?

- Will the company grow more or less cost-effectively in the future than it did in the past?

All of which help us answer the more fundamental question: will this business become better or worse as it scales?

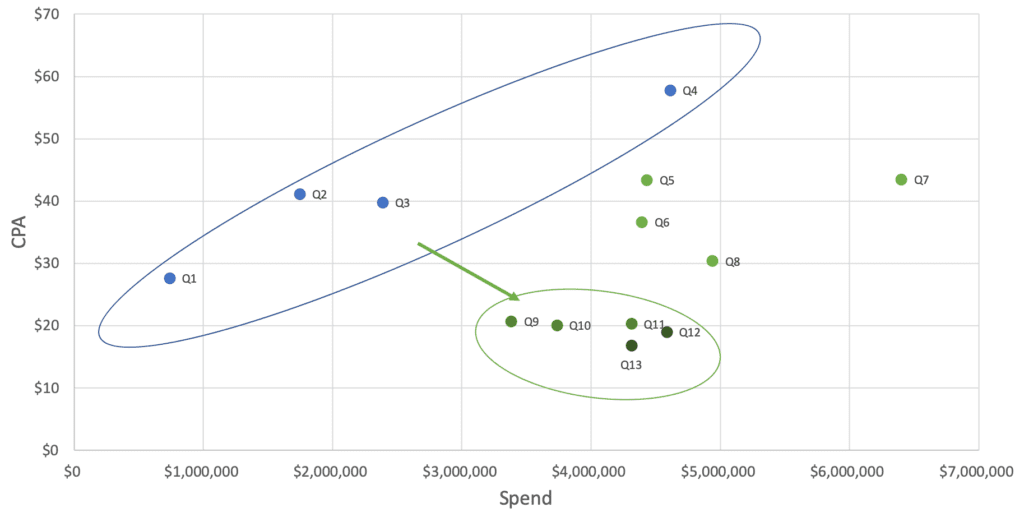

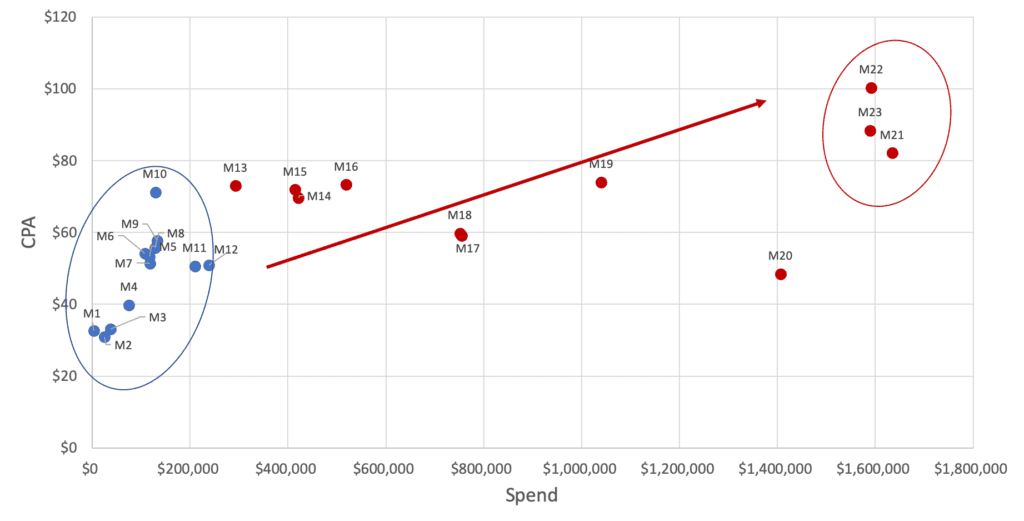

Below are two fully-anonymized examples of companies we’ve met recently. They illustrate two very different pictures of growth efficiency(ii).

Company A:

Company B:

As you can see in the charts above, Company A on the top has been able to improve CAC (customer acquisition cost) from $30-40 to roughly $20 over several years. This happens to be a business with strong network effects and increasing organic user acquisition. These CAC improvements show that the current growth engine is scaling nicely, and inspire confidence that the company will be increasingly profitable as it grows.

On the other hand, Company B’s CAC has rapidly increased from $30-60 initially to $80-100 over two years as they’ve ramped marketing spend. We see this “growth paradox” with many consumer companies — it’s easy to skim the cream and find an initial pocket of profitable user acquisition, but as they ramp paid marketing to accelerate or maintain growth, it becomes more difficult and costly to acquire each new user. Often user acquisition for these companies can turn upside-down, where an initially profitable paid growth channel becomes unprofitable over time, leaving the company to choose between two extremely challenging options: either grow unprofitably, or slow growth altogether.

Building a Sustainable Startup Growth Engine

Faced with this increasingly challenging landscape, what is a consumer tech startup to do? Below are three strategies for developing a profitable consumer growth engine that stands the test of time.

1. Invest in organic distribution

Many of this decade’s high-reach consumer companies – Zillow, Trulia, Yelp, and TripAdvisor, to name a few – were able to reach critical mass by focusing on organic distribution well before adding paid marketing to the mix. More recently Airbnb, Pinterest, and Houzz have proven that, even when you grow up in a world dominated by Google and Facebook, it’s possible to reach massive scale without spending significantly on consumer acquisition. Organic channels like SEO, email, mobile, and social continue to be extremely fertile ground. For marketplaces like Airbnb and Houzz, cross-side network effects can also be a significant driver of unpaid audience growth, as new supply brings new demand (and vice-versa).

The key is to focus maniacally and invest significantly in developing organic channels. Given they are less certain than paid channels, and usually take longer to develop, this requires commitment and discipline. At Trulia, for example, the team glorified and emphasized organic growth via SEO, email, and mobile notifications. As a result, at IPO, a significant majority of Trulia’s traffic was organic, and there was no meaningful investment in paid marketing until after we were a mature, public company.

2. Diversify your paid channels

One of the reasons why consumer marketers spend so willingly on Google and Facebook is that it’s easy! It’s much harder work to add other channels to the mix, as startup costs, time-to-market, and measurability can all be more challenging. But since when is startup life supposed to be easy? Done well, new channels can bring down your CAC, make it easier to attain a sustainable growth rate, and liberate you from the shackles of dependence on toll-takers like Facebook, Google, Apple, and Amazon.

Many successful startups have leveraged TV, radio, direct mail, content marketing, and other paid strategies to acquire new customers. Here are just a few examples of how powerful consumer companies have found success with a diverse set of acquisition channels:

- Casper’s efficient referral marketing and social media tactics

- Glossier’s ability to capitalize on its wildly successful Into the Gloss blog

- Opendoor’s provocative messaging delivered over TV, online video, and outdoor ads

- Peloton’s increasingly relatable and energizing TV ads and high-profile partnerships; as well as

- Chime Bank’s national, multi-channel ad push and investment in AI to speed up A/B testing for its online creative.

In addition, many DNVBs (digitally native vertical brands) have added retail distribution to their marketing mix. Warby Parker, Bonobos, Away, and Madison Reed are examples of companies that started as online-only and have pursued successful omni-channel strategies, growing their consumer reach and (perhaps counter intuitively) reducing CAC in the process.

3. Identify your LTV/CAC threshold and stick to it

It’s important to be highly analytical and intellectually honest when measuring the effectiveness of your spend. We’ve seen many companies get stuck in bad patterns.

One such pattern is attributing organic lift to paid marketing spend without validating it. Companies use industry guidelines or other assumptions (many of which are – surprise! – theorized by ad agencies) that may or may not be true for your business. We suggest you track each of your paid marketing channels individually, so you can isolate and understand CAC and customer lifetime value (LTV) for each channel. Hold each channel accountable for positive LTV/CAC; using blended CAC (summed across all channels) is lazy thinking and may cause you to overspend. Only attribute organic lift to your paid spend if you’ve used on/off testing to conclusively validate that there is an organic multiplier on your paid marketing. If you can’t prove it, don’t assume it’s true.

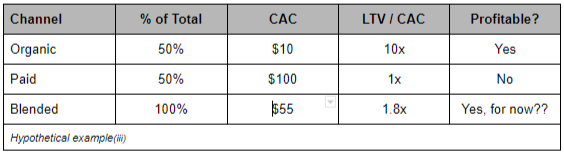

We see many examples where LTV/CAC looks good on a blended basis, but in reality the company has a healthy and profitable organic channel, paired with an unprofitable or less healthy paid channel.

For example, imagine you’re the CEO of the hypothetical company represented above. The company has a customer LTV of $100. Blended CAC is $55, and thus blended LTV/CAC is an acceptable 1.8x. But when half of your users are acquired via paid marketing, with paid CAC of $100, then in reality your paid acquisition program is not profitable today, and the next user you acquire will likely cost you more than $100. Pair a marginally profitable paid channel with the increasing CAC trends on Facebook and Google, and you’ll find it’s difficult to scale profitably in the future. Remember, you don’t want to fall into the same “growth paradox” as Company B that we highlighted above.

Remain Focused to Remain Competitive

It’s by no means an easy course for today’s high-growth consumer startups. It’s essential for consumer teams to create a differentiated product and build a strong, diverse set of growth channels from the very beginning; over-reliance on Facebook and Google is a dangerous strategy. Moreover, when funds are limited, it’s critical to make every marketing dollar count and prove your resourcefulness to attract capital.

While there’s never a one-size-fits-all solution, using the above guidelines to grow organic traffic, make intelligent investments across channels, and remain honest about your LTV/CAC ratio will help ensure that you build the foundation you need to stay in the game.

Thanks to Sapphire Ventures Associate Alex Lehman for her analytical support on this piece.